The results are in: labour tops the challenges and opportunities lists, contractors performed better than anticipated in 2022.

The Sheet Metal Journal Construction Outlook Survey is a valuable tool for garnering feedback on the industry’s concerns and opportunities moving into the coming year. Our team reviews each completed survey and comment and provides relevant details here, in this yearly analysis of members’ thoughts, and to SMACNA-BC to help the office shape its service offering for the year.

Demographics

First, let’s explore who answered the survey. Contractors made up 58% of respondents to this year’s survey. Another 22% were suppliers, 15% were manufacturers, and 10% simply identified as Local 280 members. Of those, 54% consider HVAC their company’s specialty. Companies representing architectural, industrial, and specialty/custom specialties represented 10, 12, and 15% of respondents, respectively, while 13% represented TAB contractors and another 15% selected “other”, such as pollution control and specialty ventilations. Note, some contractors identified more than one specialty, hence the total exceeding 100%.

Construction’s status as essential service work carried most contractors through 2021, and in 2022, most businesses continued to thrive, despite labour challenges. Asked how they expected their businesses to perform last year over 2021, 54% responded “above average”, while the rest replied “same as 2021” (27%), “a little down” (13%), and “better than expected” (6%). None of the respondents anticipated their “worst year ever”, which is encouraging.

Real and Anticipated Performance 2022-23

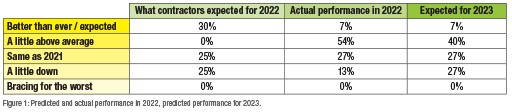

Actual performance in 2022 exceeded those expectations. While the data may or may not represent the predictions and actual performance of the same group of contractors surveyed last year, Figure 1 does represent an overall view of how contractors expected to perform in 2022 and how they actually performed. Interesting to note is that 54% of contractors perfromed above average while none expected this. While 25% of contractors expected to be “a little down” for 2022, only 13% reported this was the case for thier businesses. Predictions for 2023 are cautious but similar to actual performance in 2022, with 14% fewer contractors expecting to come out above average and 14% more expecting business to drop off slightly over this year.

Opportunities, Challenges, and Investments

Labour is, of course, an ongoing concern in all industries, but it is especially important in a trade that fabricates its materials and components and requires a high-skilled and trained workforce to get the job done to SMACNA’s high standards. But contracotrs are tackling the challenge with investment and action plans to bulk up the labour supply.

Respondents plan to invest in recruitment and retention (73%), technology (47%), training (33%), and expanding (33%), while none of the respondents plan to leave the industry this year.

Looking ahead to industry areas that present opportunities, most contractors identified those related to recruitment. “We must attract new tradespeople at the high school level, showing that the trades can be a profitable career,” said one respondent. “Comparing to previous decades, entry level out of high school is extremely low.”

Others suggested bringing in trained foreign workers, encouraging new, young people to get properly trained in the industry, and optimizing current teams so companies can work most effectively with the personnel already in place.

Labour shortage isn’t the only concern relating to recruitment. Several respondents identified low quality of workpersonship on projects due to lack of skilled labour and one saw an opportunity in using BIM to reduce wastage and rework caused by inexperienced workers running projects.

Several see opportunities in new (to them) markets, including residential and TAB, and in political advocacy for the skilled trades.

“We need coordinated efforts to drive more people to the trades and leveraging new or different labour pools,” said one respondent. “We need this to grow the industry, create cultural awareness and acceptance, and dispel or reduce sexism and racism in the trade.”

Support Needed

Contractors closed the survey with several suggestions for the type of support they would like to help support their businesses as they move into 2023. See below for a list, and keep an eye on your email for development opportunities offers through SMACNA dinner meetings and on-going professional development.

SMACNA-BC Member Support Wishlist 2023

1. Recruitment support: 73%

2. Management training: 45%

3. Grants & tax incentives: 20%

4. Business operations: 20%

5. Political advocacy: 16%

6. Cultural awareness, diversity, equity & inclusion: 18%

7. General education and training: 13%

8. Other: 13% (market expansion [ie, schools, IAQ], communication skills, labour-management development to support training in new areas, leadership, event planning, TAB, strategies to help smaller business and job shops survive against cheaper outsourced markets, labour-management cooperation. ■